What is NTN Registration?

The National Tax Number (NTN) is a unique identification number issued by the Federal Board of Revenue (FBR) for individuals and businesses to fulfill their tax obligations. It is required for tax filing, business transactions, and financial dealings in Pakistan.

Importance of NTN Registration

- Mandatory for Tax Filing – Essential for individuals and businesses to file income tax returns.

- Legal Business Operations – Required for conducting lawful business transactions.

- Bank Account Opening – Necessary for opening a business bank account.

- Participation in Government Tenders – Many contracts require businesses to have an NTN.

- Claiming Tax Benefits – Allows businesses and individuals to avail tax exemptions and refunds.

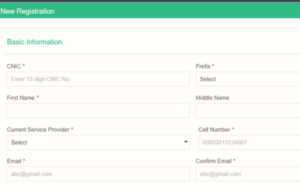

Requirements for NTN Registration

- CNIC (For Individuals)

- Business Registration Certificate (For Companies)

- Bank Account Details

- Office Address & Contact Information

- Proof of Income or Business Activities

Getting an NTN is the first step towards tax compliance and financial credibility. Let us assist you in obtaining your NTN quickly and hassle-free!